Insurance Covers Massage: Does insurance cover massage in Ontario?

- tmcpnet

- Feb 8

- 14 min read

Yes, in many cases, your insurance can cover massage therapy, but it's not a simple yes-or-no answer. It really comes down to the specifics of your plan and the type of treatment you’re getting.

The biggest distinction to make right away is that the provincial plan (OHIP) won't cover it. Instead, coverage almost always comes from private extended health insurance plans. The golden rule for getting your treatment covered is that it must be performed by a Registered Massage Therapist (RMT) for a therapeutic, medically necessary reason.

Understanding How Insurance Covers Massage in Ontario

Trying to figure out your insurance benefits can feel like you’re trying to solve a puzzle with half the pieces missing. But when it comes to massage therapy, the picture is actually clearer than you might think. Here in Ontario, the whole system is built to separate a general relaxation session from professional, targeted healthcare.

This is where the role of a Registered Massage Therapist becomes absolutely critical.

Insurance companies see RMTs as recognized healthcare professionals. That’s because they’re regulated by the College of Massage Therapists of Ontario (CMTO), a body that sets high standards for education, ethics, and practice. So, when you get treatment from an RMT like our male therapist, Taylor, your insurer views it as a legitimate therapeutic service, not just a spa-day indulgence.

The Focus on Therapeutic Care

The core idea behind insurance coverage is "medical necessity." Think of it less like treating yourself and more like a prescribed treatment for a specific health problem. Your insurance plan is there to help you manage conditions, recover from injuries, and improve your overall quality of life.

This is especially important for our clients in Brampton, Toronto, Etobicoke, Oakville, Caledon, Orangeville, Mississauga, Milton, Halton, and Guelph who need specialized care right in their own homes. Insurance coverage is typically designed for treatments that aim to:

Manage chronic pain from conditions like arthritis.

Rehabilitate an injury after a fall or surgery.

Improve mobility and reduce stiffness.

Alleviate symptoms tied to neurological conditions.

Private health insurance is your ticket to accessing these benefits. According to PolicyMe, a Canadian insurance provider, while OHIP doesn't cover massage, over 69% of Canadians have their costs at least partially covered through private health plans. The details matter, though. Some plans might offer a $600 annual limit with 50% reimbursement, while others could provide up to $1,000 at 80%. This is exactly why digging into the details of your specific plan is always the first step. You can find out more about how Canadian insurance plans handle massage therapy.

By focusing on the therapeutic purpose of your massage—whether it's Joint Mobilization or Myofascial Release—you align your treatment with the goals of your insurance provider, making the claims process much more straightforward.

To make things even clearer, here’s a quick breakdown of what you need to have in place to ensure your claim goes through smoothly.

Quick Guide to Massage Therapy Insurance Coverage

This table summarizes the essential requirements for getting massage therapy covered by insurance in Ontario.

Requirement | Why It Matters for Coverage | Example |

|---|---|---|

Treatment by an RMT | Insurers only recognize therapists registered with the CMTO as legitimate healthcare providers. | The receipt must show the therapist's name and their valid CMTO registration number. |

Medical Necessity | The massage must be for treating a specific health condition, not just for general relaxation. | A doctor's note prescribing massage for lower back pain or post-surgical scar tissue management. |

Detailed Receipt | The receipt acts as official proof of service for the insurer, containing all required information. | An official receipt including the date, service provided (e.g., 60-minute massage), cost, and RMT's details. |

Coverage Limits | Your plan will have a maximum annual dollar amount and/or a co-payment percentage. | Your plan covers 80% of each session up to a maximum of $750 per year. |

Getting these four things right is the key to successfully using your benefits. Always double-check your policy documents or call your provider if you’re unsure about any of these points.

How to Decode Your Extended Health Benefits

Think of your extended health benefits plan as your personal wellness fund, set aside to help you pay for crucial healthcare services that provincial plans don't cover. Getting a handle on how to access this fund is the key to making therapeutic massage an affordable part of your care routine.

At first glance, the language in your benefits booklet can feel like it's written in another language. But once you break it down, it all comes back to a few core concepts that explain how you and your insurer share the cost of your treatments. Figuring these out is the first step toward knowing exactly what you'll pay out-of-pocket for services like Swedish massage, Cupping therapy, Deep tissue massage, Rehabilitation massage, Myofascial release, Trigger point release, Joint mobilization, Hydrotherapy applications, Geriatric massage, Sports massage therapy, and Energy healing.

Key Terms in Your Insurance Plan

To really understand if insurance covers massage for you, you need to speak the insurer's language. Let's translate the most common terms you'll run into when looking at your policy from providers like Sun Life, Manulife, or Green Shield.

Annual Maximum: This is the absolute highest dollar amount your plan will pay for a specific service—like massage therapy—within your benefit year. If your maximum is $750, once you've claimed that much, your insurer won't cover any more until your plan renews next year.

Co-payment (or Co-insurance): This is simply the percentage of the treatment cost that you're responsible for. If your plan covers 80%, your co-payment is the leftover 20%. So, for a $120 session, your plan pays $96, and you cover the remaining $24.

Deductible: Think of this as the amount you have to pay yourself before your insurance coverage kicks in. For example, if you have a $100 deductible, you'll need to pay for the first $100 of your treatments out-of-pocket. After that, your co-insurance begins. The good news? Many modern plans have dropped the deductible for massage, but it’s always something you need to double-check.

Knowing these three terms is all it takes to figure out the true cost of your care. For a deeper look at what goes into service costs, you can read our guide on massage rates and value.

A Practical Example of Coverage

Let’s walk through a real-world scenario. Imagine your plan has the following details:

Annual Maximum for Massage: $500

Co-insurance: 80% coverage

Deductible: $0

You book a 60-minute in-home massage, which costs $120. Since your deductible is zero, your coverage starts from the very first dollar.

Your insurer covers 80% of the cost ($96), and your out-of-pocket portion is just $24. That $96 paid by the insurer is then subtracted from your $500 annual maximum, leaving you with $404 in coverage to use for the rest of the year.

By knowing these figures ahead of time, you can confidently plan your therapeutic care throughout the year. It lets you maximize your benefits and get consistent care for managing pain or improving mobility—all without any nasty financial surprises.

Why Your Therapist Must Be a Registered RMT

When you use your extended health benefits for a massage, you're not just booking a relaxing spa service—you're accessing professional healthcare. Insurance companies in Ontario see it the same way, and that’s why they have one very firm rule: for a massage to be covered, it must be performed by a Registered Massage Therapist (RMT).

It's a distinction that makes all the difference. An RMT is a recognized healthcare provider, and that professional standing is precisely what gives insurers the confidence to pay out a claim. Without the RMT designation, a massage is simply considered a wellness expense, not a medical one, and unfortunately, it won't be covered.

What It Really Takes to Become an RMT

Becoming an RMT in Ontario is no small feat. The whole process is overseen by the College of Massage Therapists of Ontario (CMTO), and it's far more demanding than a simple weekend course. It requires a serious commitment to understanding the complexities of the human body.

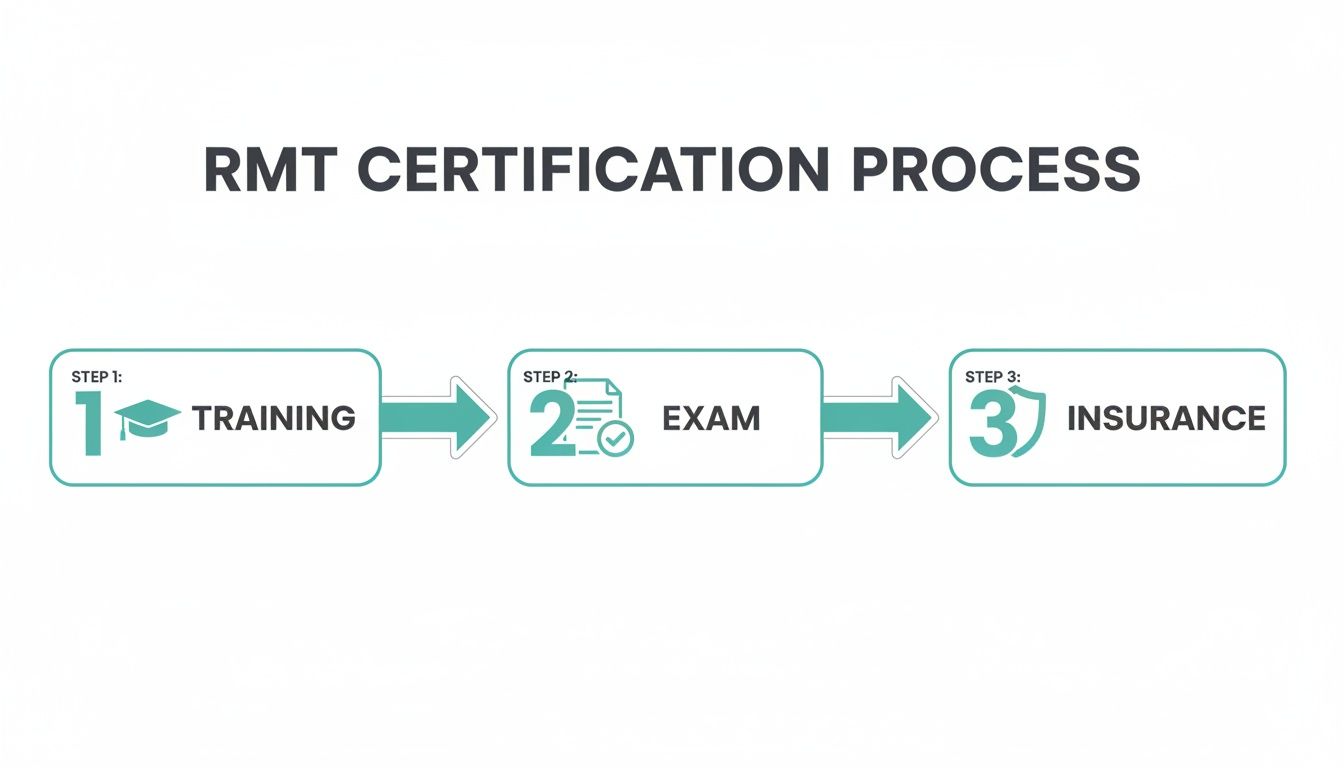

Here's a quick look at the journey:

Intensive Education: Before they can even think about practicing, candidates must complete a challenging program with over 2,200 hours of in-depth academic study and hands-on clinical training.

Provincial Licensing Exams: Once they graduate, they face a series of tough written and practical exams to prove they are competent, safe, and ready to treat the public.

Career-Long Learning: The learning doesn't stop there. RMTs are required to pursue ongoing professional development to stay sharp and up-to-date on the latest research and techniques.

These high standards are in place for a reason. They ensure that when you see an RMT, you’re in the hands of a professional who has a deep, practical knowledge of anatomy, physiology, and pathology. You can dive deeper into what defines Registered Massage Therapy in our detailed guide.

The Protection and Professionalism Insurers Count On

On top of the rigorous education, the CMTO requires every single RMT to carry significant professional liability insurance. This isn't just a suggestion; it's a mandatory part of being registered, and it's a huge reason insurance covers massage from RMTs. It acts as a safety net, protecting both you and the therapist, which is something insurers value immensely.

In Ontario, the CMTO mandates that all members maintain liability insurance of at least $2 million per occurrence and $5 million in total per year. This professional standard is one of the key pillars that allows private insurance companies to confidently reimburse RMT services.

This blend of regulation, education, and mandatory insurance is what elevates RMT services from a simple relaxation treatment to a legitimate form of healthcare. It's the reason insurers will cover things like Rehabilitation Massage for an injury or Joint Mobilization to help with arthritis.

When you book a mobile massage with our RMT, Taylor, you can rest assured that you're receiving care from a fully licensed and insured professional. We meet all CMTO requirements, which means every treatment we provide is not only therapeutically effective but also fully eligible for your insurance claim.

Claiming Your Massage Benefits Step by Step

Getting your money back for a massage therapy session shouldn't be a headache. While the world of insurance claims can feel a bit tangled, it really just comes down to a few key steps. Let's walk through exactly what you need to do, from before you even book your appointment to submitting the final paperwork.

The whole process actually starts before you're on the massage table. A quick phone call to your insurance provider or a look at your online benefits portal can save you a world of trouble later. Some plans insist on a doctor's note or referral before they'll cover massage therapy, so you absolutely want to confirm that first. This little bit of prep work ensures your treatment is pre-approved and fits what your insurer considers a medical necessity.

Preparing for a Successful Claim

Once you've sorted out any requirements like a doctor's note, your focus can shift to the appointment itself—and the paperwork that comes with it. The single most important document you'll need is a proper receipt from your therapist. Insurers are notoriously picky about what this receipt must include.

Our male RMT, Taylor, makes sure every receipt you get is detailed and ready for your insurance company. It will always have:

Your full name and the date of your treatment.

A clear description of the service (like a 60-minute therapeutic massage).

The total cost of the session.

Taylor’s name and official CMTO registration number.

That last point is the big one. An RMT's registration number is the proof your insurance company needs that the service was performed by a licensed professional, which is what makes it eligible for coverage. It’s non-negotiable.

This infographic breaks down the rigorous journey an RMT undertakes, which is precisely why insurers recognize and trust their credentials.

It's this combination of in-depth training, provincial exams, and mandatory liability insurance that solidifies an RMT's status as a recognized healthcare provider whose services are covered.

Submitting Your Claim for Reimbursement

With that official receipt in your hands, you generally have two ways to get paid back. The first is direct billing, where the clinic bills your insurer for you. The second—and often more common—method is to pay upfront and submit the claim yourself. If you're curious about the backend administrative work, you can find more info on medical billing.

We provide you with the perfect receipt to submit the claim yourself. This is usually a surprisingly fast and simple process using your insurer’s website or mobile app. You just snap a photo of the receipt, enter a few details, and the money is often back in your account within a few business days.

This simple process puts you in the driver's seat, allowing you to manage claims with total confidence. To see how this compares to other options, check out our guide on direct billing for RMT services.

What Conditions and Treatments Get Covered

Insurance plans are built to help you get better, not just to pay for a relaxing spa day. This is the single most important thing to remember, and it all comes down to one core concept: medical necessity. While a general relaxation massage likely won't make the cut, a therapeutic treatment focused on a specific health issue almost certainly will.

When an insurance adjuster looks at your claim, they're searching for a clear, logical line connecting the treatment you received to a diagnosed health condition. It’s like connecting the dots for them: your chronic lower back pain (the condition) is being treated with Deep Tissue Massage and Trigger Point Release (the treatment). That direct link is precisely what makes the service eligible for coverage.

Aligning Your Treatment with Your Health Goals

For our clients here in Brampton, Toronto, Etobicoke, Oakville, Caledon, Orangeville, Mississauga, Milton, Halton, and Guelph, we see coverage approved most often for conditions that genuinely get in the way of daily life. This usually involves managing chronic pain, recovering from an injury, or working to improve mobility. The trick is to show that the massage is a legitimate part of the solution to a real health problem.

Our RMT, Taylor, focuses on therapeutic services designed for these exact situations. Here are a few of the most common scenarios where we see insurance covering massage:

Arthritis Management: Geriatric Massage and careful Joint Mobilization can be a game-changer for reducing stiffness, easing that deep ache in the joints, and improving overall range of motion.

Post-Injury Rehabilitation: After a fall or surgery, Rehabilitation Massage and Myofascial Release are crucial for breaking down restrictive scar tissue and helping you get back to normal function.

Chronic Pain Relief: Nagging conditions like sciatica or the widespread pain of fibromyalgia often respond incredibly well to Deep Tissue Massage and Trigger Point Release, which get to the root of the discomfort.

Neurological Conditions: For clients living with MS or Parkinson's, specialized massage techniques can help manage muscle spasticity and improve motor control and coordination.

If you want to dig a bit deeper into how these techniques work, especially for joint issues, check out our article on the role of massage in managing arthritis and joint pain.

To help you see how this works in practice, here’s a quick breakdown of common health issues and the RMT services that insurance providers typically recognize as valid treatments.

Insurance-Covered Conditions and Corresponding Massage Therapies

Common Condition | Therapeutic Goal | Recommended RMT Service We Offer |

|---|---|---|

Osteoarthritis/Rheumatoid Arthritis | Reduce joint inflammation, improve mobility, and manage pain. | Geriatric Massage, Joint Mobilization |

Post-Surgical Recovery | Decrease scar tissue formation, restore range of motion, and reduce swelling. | Myofascial Release, Rehabilitation Massage |

Sciatica/Lower Back Pain | Release nerve compression, reduce muscle tension, and alleviate referred pain. | Deep Tissue Massage, Trigger Point Release |

Sports Injuries | Reduce inflammation, improve circulation, and speed up recovery. | Sports Massage Therapy, Cupping Therapy |

Tension Headaches/Migraines | Release tension in neck and shoulder muscles, improve circulation. | Swedish Massage, Trigger Point Release |

General Wellness & Stress | Promote relaxation, reduce stress, and improve circulation. | Swedish Massage, Hydrotherapy Applications |

This table shows just how specific and targeted therapeutic massage can be. It’s not a one-size-fits-all approach; it’s about applying the right technique to achieve a clear medical outcome.

The fact that massage is so widely used for these conditions is no secret. A 2016 scan of the profession found that massage therapy is the most frequently claimed paramedical benefit in Canada, with an impressive 69% of users having some form of insurance coverage. This widespread acceptance has led to very high professional standards in Ontario, solidifying the role of RMTs as trusted healthcare providers.

By clearly identifying the therapeutic goal—whether it's reducing inflammation, increasing mobility, or alleviating chronic pain—you demonstrate the medical value of your treatment. This helps ensure your claim aligns perfectly with what your insurance plan is designed to cover.

Your Next Steps for Covered Massage Therapy

Now that we've walked through the ins and outs of insurance coverage, you’re in a great position to use your benefits for massage therapy. It really boils down to knowing your plan and making sure you’re working with the right professional.

Think of it as a simple, three-step checklist. First, give your insurance provider a quick call or check their portal to confirm your coverage limits and see if you need a doctor's note. Second, make sure your treatments are with a provincially registered RMT—this is non-negotiable for claims. And finally, hang onto that detailed receipt after every session; it’s your key to getting reimbursed without any fuss.

We Bring the RMT to You

We take the hassle out of the equation by bringing professional, insurance-eligible massage therapy right to your home. Our mobile service is perfect for anyone in Brampton, Toronto, Etobicoke, Oakville, Caledon, Orangeville, Mississauga, Milton, Halton, and Guelph who needs therapeutic care without the stress of travel.

Our RMT, Taylor, is skilled in a wide range of therapies, from Deep Tissue Massage to Geriatric care, ensuring every treatment is thoughtfully adapted to your specific health needs and goals.

Ready to put your benefits to good use?

Your wellness is just an appointment away. Let us bring the healing to you, while you enjoy the peace of mind that comes with knowing your treatment is designed for your comfort, recovery, and is covered by your insurance.

Book your session with Taylor now and let us handle the rest.

Your Massage Insurance Questions Answered

When you're trying to figure out insurance, it's easy to get tangled up in the details. Let's clear up some of the most common questions we hear about using your benefits for mobile RMT services so you can book your appointment with confidence.

Do I Need a Doctor’s Note for Insurance to Cover My Massage?

That really comes down to your individual insurance plan. Some insurers absolutely require a doctor’s referral or prescription before they'll cover massage therapy, and you might even need to get it renewed each year. On the other hand, many plans don't require one at all.

The best thing you can do is check before you book. A quick look at your benefits booklet or a call to your insurance provider will give you a definite answer. Taking a few minutes to confirm this upfront is the surest way to avoid any surprises when you submit your claim.

Will My Insurance Cover In-Home or Mobile Massage Therapy?

Yes, almost always. For most insurance companies, the location of the massage isn't what matters. What they really care about is who is providing the treatment.

As long as your massage is performed by a Registered Massage Therapist (RMT) who is in good standing with their provincial college (like the CMTO in Ontario), the service qualifies for coverage. So, our mobile massage services provided by Taylor are fully eligible for insurance claims.

After your session, we'll give you an official receipt with all the details you need for a smooth reimbursement.

Do You Offer Direct Billing to My Insurance?

At the moment, we don't offer direct billing. The process is simple: you pay for your session at the time of your appointment, and we provide you with a detailed, official receipt.

This receipt has everything your insurance company needs to process your claim. You can then easily submit it through your provider's website or mobile app. This way, you have a complete record of the payment and stay in full control of your benefits.

What Should I Do if My Massage Claim Is Denied?

Don't panic! If your claim gets denied, the first step is to call your insurance provider and ask why. It's often for a simple reason that's easy to fix.

Here are a few common reasons a claim might be rejected:

You've already used up your plan’s annual coverage limit.

Your plan requires a doctor’s note that wasn't submitted.

There was a small clerical error when the claim was filed.

We always make sure our receipts are accurate and complete to help prevent these kinds of issues. If a denial does happen, your insurer will tell you exactly what went wrong based on your policy, and from there, you can figure out the next steps.

Ready to experience the relief and convenience of a professional massage in your own home? We bring expert therapeutic care to you in Brampton, Toronto, Etobicoke, Oakville, Caledon, Orangeville, Mississauga, Milton, Halton, and Guelph.

Book your session online today and let Taylor help you on your path to wellness.