A Guide to Insurance Covered Massage in Ontario

- tmcpnet

- Dec 1, 2025

- 12 min read

Yes, there's a good chance your employee benefits or extended health plan will cover therapeutic massage. The catch? The treatment needs to be from a Registered Massage Therapist (RMT) and for a medically necessary reason, like managing pain or recovering from an injury—not just for general relaxation.

How Insurance-Covered Massage Actually Works

It's surprising how many people in Brampton, Mississauga, and Toronto have benefits that include an insurance-covered massage but never use them. Figuring out how your coverage works is the first real step to making this kind of therapeutic care an affordable part of your health routine.

The whole system hinges on one key concept: medical necessity. Insurance providers see massage therapy as a legitimate healthcare service when it’s used to treat a specific health issue. This could be anything from chronic back pain and tension headaches to recovering from a sports injury or a car accident. Getting a basic feel for how insurance works in general can make this whole process a lot clearer.

What Is a Registered Massage Therapist (RMT)?

Here in Ontario, if you want your insurance to cover a massage, it has to be performed by a Registered Massage Therapist (RMT). This isn't just any massage provider; an RMT is a healthcare professional who has gone through rigorous training and is registered with the College of Massage Therapists of Ontario (CMTO).

That registration is the golden ticket. It tells insurance companies that you're receiving treatment from a qualified practitioner who follows strict professional and ethical standards. Our male RMT, Taylor, meets all these criteria, so you can be confident every session is both therapeutic and fully compliant with insurance requirements. To learn more, check out our guide on what an RMT in Ontario is and what they do.

Services Often Covered by Insurance

When an RMT includes specific techniques as part of your overall treatment plan, many of them become eligible for coverage. This gives you access to the right kind of care without the full financial burden.

Here are a few common services that your plan might cover:

Swedish Massage: Often used to boost circulation and ease general muscle soreness.

Cupping Therapy: Can be covered when it's part of an RMT's integrated treatment.

Deep Tissue Massage: Fantastic for targeting chronic muscle tension and stubborn knots.

Rehabilitation Massage: A key part of supporting recovery after an injury.

Myofascial Release: Used to treat pain and immobility in the skeletal muscles.

Trigger Point Release: Aims to relieve pain caused by specific tight spots in your muscles.

Joint Mobilization: Gentle movements to improve joint function and reduce pain.

Hydrotherapy Applications: Using heat or cold to complement massage treatment.

Geriatric Massage: Gentle techniques adapted for the needs of older adults.

Sports Massage Therapy: Focused on both preventing and treating sports-related issues.

Energy Healing: Please note, this service is typically not covered by insurance plans.

With these basics in hand, you can start digging into your own insurance policy with more confidence. The goal is to empower you to use the benefits you're already paying for, especially for treatments with Taylor in Brampton, Etobicoke, Milton, and the surrounding areas. In the next sections, we'll walk through exactly how to check your plan and get ready for your appointment.

Making Sense of Your Extended Health Benefits Plan

Getting your massage therapy covered starts with one crucial step: understanding your extended health benefits plan. It can feel like you're trying to decipher a secret code, but once you know what to look for in your plan documents or online portal, it all starts to click.

Think of it like a treasure map. You're looking for the section on paramedical services, which is where you'll almost always find Registered Massage Therapy listed. Once you've found it, hunt for two key numbers: your annual coverage limit and your per-visit maximum. The annual limit is the total dollar amount your plan will pay for massage therapy in a year, while the per-visit max is the most they'll chip in for any single appointment.

Getting a Handle on Insurance Lingo

As you dig into your policy, you'll bump into a few terms that directly affect how much you'll pay out-of-pocket. They sound more complicated than they are.

Deductible: This is simply the amount you have to pay first before your insurance company starts paying. If your plan has a $100 deductible, you’ll cover the first $100 of your massage costs for the year. After that, your coverage kicks in.

Co-pay: This is a flat fee you pay for each session. For instance, if your co-pay is $20 for a massage, you pay that $20, and your insurer handles the rest (up to that per-visit limit we talked about).

Percentage Covered (Co-insurance): This is a very common setup. Many plans cover a percentage of the cost, usually around 80% or 90%. So, if your plan covers 80% of a $120 massage, you'd be responsible for the remaining 20%, which works out to $24.

Getting these details sorted out beforehand means you can budget properly and avoid any surprise bills, letting you fully relax during your session with our RMT, Taylor, whether you're in Oakville or Guelph.

Why You Might Need a Doctor's Note

Don't overlook this one—it’s a common stumbling block for getting an insurance covered massage. Many providers require a doctor's note, sometimes called a referral or a prescription, before they'll even look at a claim. This note is their proof that the treatment is medically necessary.

It's more common than you might think. A regional analysis of insurance policies revealed that 27% of them required a physician's prescription to authorize coverage. That same study also highlighted how wildly different plans can be, with some even excluding Registered Massage Therapists as eligible providers. If you're curious, you can dig into the full research on insurance reimbursement policies.

A Quick Script for Calling Your Insurer

The best way to get straight answers is to pick up the phone. When you call your insurance provider, you can use this as a guide to get right to the point:

"Hello, I'm calling to confirm the details of my coverage for Registered Massage Therapy. My policy number is [Your Policy Number]. Could you please tell me what my annual limit is and if there’s a per-visit maximum? I also need to check if a doctor's referral is required. One last thing—are specific services like cupping or sports massage covered if they're part of an RMT's treatment plan?"

This direct approach cuts through the confusion and gives you everything you need to know before you book. If you want to learn more about what a qualified RMT does, take a look at our guide to a Registered Massage Therapist.

Direct Billing vs. Self-Submission: What's the Difference?

So, you've confirmed your insurance plan covers massage therapy. Great! The next piece of the puzzle is figuring out how the payment actually works. When it comes to an insurance-covered massage, you generally have two paths: direct billing or submitting the claim yourself.

Let's break down what each one means so you can decide which route is best for you.

The simplest, most hands-off option for many people is direct billing. It’s exactly what it sounds like: we bill your insurance company directly for your treatment. You just pay the difference—if there is any. This could be a small co-pay or any amount that goes over your per-visit limit. It’s a smooth process that keeps your upfront costs to a minimum.

The Self-Submission Route

The other option is to pay us first and get reimbursed by your insurer later. We call this self-submission. You’d pay for your full session with Taylor at the end of your appointment, and we’ll give you an official RMT receipt with all the details your insurance company needs.

This receipt is your ticket to getting your money back. It will always include:

Taylor’s full name and RMT registration number

The date and length of your massage

A clear description of the service (i.e., Registered Massage Therapy)

The total cost and proof that you’ve paid

From there, you just need to upload a picture of the receipt to your insurer’s online portal or mobile app. Most companies are pretty quick about it and will deposit the reimbursement into your bank account within a few business days.

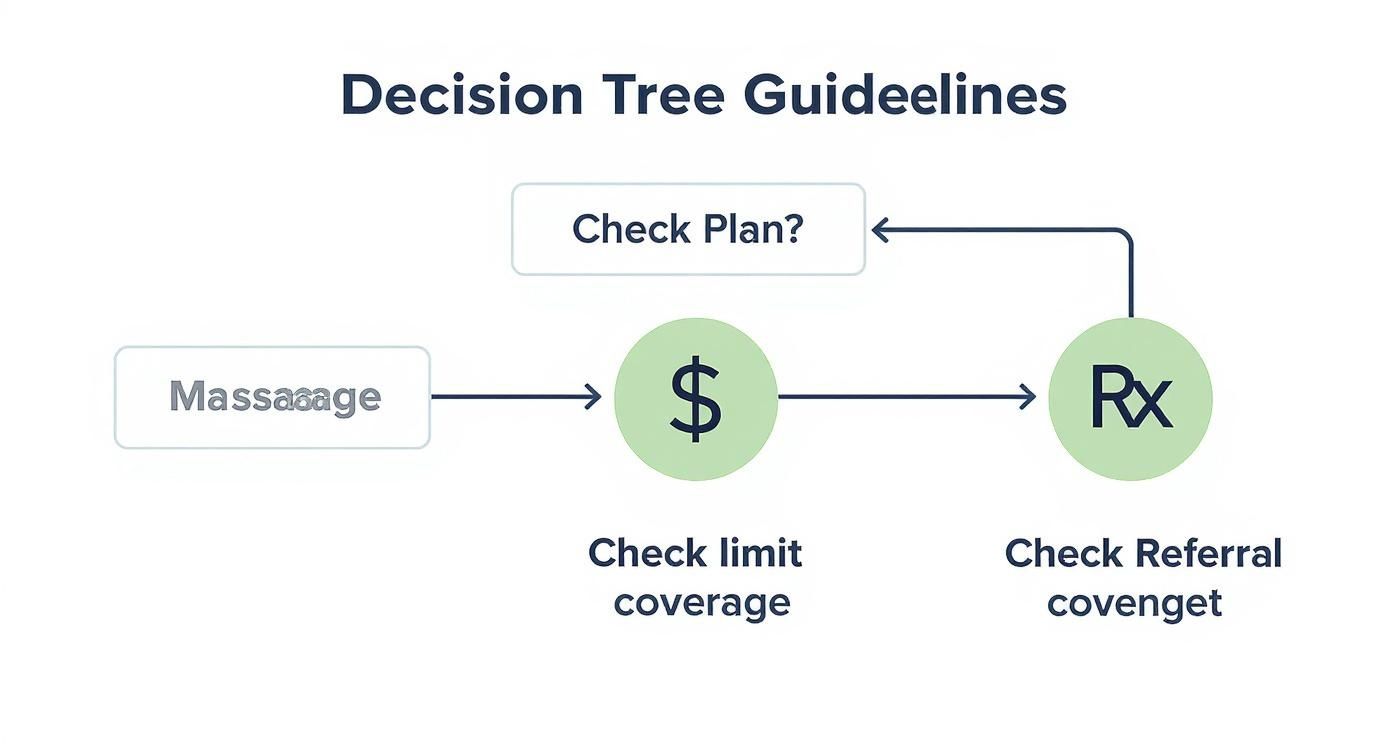

This decision tree gives a nice visual of the steps involved in checking your coverage before you even get to the billing part.

As you can see, confirming your plan details, coverage limits, and whether you need a doctor's note are the first things you need to sort out.

How to Choose What's Right for You

Honestly, the choice between direct billing and self-submission usually boils down to personal preference and cash flow. If you prefer to avoid paying the full amount out of pocket, direct billing is a fantastic, hassle-free option that our clients in Brampton, Oakville, and Caledon really appreciate.

On the other hand, some people like the control that comes with self-submission. You manage the claim yourself, see the full transaction from start to finish, and can easily keep tabs on your claim history and reimbursements.

No matter which way you go, my best advice is to stay organized. Keep a digital folder on your computer or phone for all your RMT receipts and any emails from your insurer. It makes it so much easier to track your spending and find what you need if any questions pop up.

For a deeper dive into this, check out our guide to direct billing for massage in Brampton and the GTA.

Using Insurance for Accident and Workplace Claims

Beyond your everyday employee benefits, there are other critical ways to get an insurance covered massage, particularly if you're recovering from an injury. If you've been hurt in a car accident or on the job, your auto insurance or the Workplace Safety and Insurance Board (WSIB) often come into play. Just know that these processes look quite different from using a standard extended health plan.

Getting these claims sorted requires everyone to be on the same page. Clear and consistent communication between you, your doctor, the insurance adjuster, and your RMT, Taylor, is the key to making sure your treatments get approved and covered without any bumps in the road.

Motor Vehicle Accident (MVA) Claims

After a car accident in places like Mississauga or Brampton, therapeutic massage can be a game-changer for recovering from injuries like whiplash or severe back strain. In these situations, your auto insurance is your primary route for funding the care you need.

To kick things off, your RMT has to submit a specific form called an OCF-18 Treatment and Assessment Plan. This document lays out the proposed massage therapy sessions, makes the case for why they're medically necessary for your recovery, and gives a breakdown of the costs. It's crucial that your insurance adjuster approves this plan before you start your treatments; otherwise, coverage isn't guaranteed.

The system is set up to provide essential care, but let's be honest, auto insurance frameworks can be tricky to navigate. While systems like Personal Injury Protection (PIP) are designed to help, the reality isn't always smooth. Nationally, it's estimated that no-fault auto insurance fraud can cost billions, which unfortunately affects policyholders everywhere. You can read more about how auto insurance can cover therapeutic care to get a better sense of the bigger picture.

Workplace Safety and Insurance Board (WSIB) Claims

If you get injured at work, WSIB is the organization that manages your claim and recovery plan. Getting them to approve massage therapy involves a few steps to show that the treatment is a necessary part of getting you back on your feet and back to work.

WSIB's main goal is to help you recover safely and get back to work in a timely manner. Massage therapy is often seen as a powerful tool in a rehab program because it helps manage pain, ease muscle tension, and get you moving again.

First things first, WSIB has to approve your claim. Once that's done, your family doctor or another treating physician can recommend massage therapy as part of your overall recovery strategy. From there, we collaborate with your healthcare team to design a treatment plan that specifically targets your work-related injury. For anyone going through this, getting a handle on your rights and the process for WSIB insurance in Ontario is essential to accessing all the care you deserve.

Whether it’s an MVA or a WSIB claim, remember that massage is usually one piece of a larger recovery puzzle. You might find yourself weighing different treatment options. If that’s the case, our article comparing physiotherapy vs. massage therapy could offer some helpful perspective.

Getting Ready for Your First RMT Session

Once you’ve got the green light from your insurance company, it’s time to book your appointment. A little bit of prep work can make a huge difference in how smoothly your first visit goes, helping you get the most out of your insurance covered massage. When you know what to bring and what to expect, you can relax and focus on what really matters—your treatment.

Think of this first session as building the foundation for your entire treatment plan. The initial assessment is a critical step, especially when insurance is involved, as it documents the medical necessity of your massage therapy from day one.

What to Bring to Your Appointment

Coming prepared means Taylor can get right to focusing on your treatment. Having a few key things on hand ensures all the admin stuff is taken care of quickly, whether you're in Orangeville or Milton.

Before you head to your session, just make sure you have these items with you:

Your Insurance Information: Have your physical or digital insurance card ready. We’ll need the policy and group numbers for direct billing or to make sure your receipt has all the details for you to submit a claim yourself.

A Doctor's Note (If Required): If your insurance provider mentioned you need a referral, don’t forget to bring it. For many plans, this is a must-have for coverage.

Relevant Health History: Be prepared to chat about any past injuries, surgeries, chronic conditions, or medications. It all helps build a complete picture of your health.

Running through this quick checklist makes sure all the i's are dotted and t's are crossed, so the session can be all about your wellness goals.

The Initial Assessment with Taylor

Your first appointment will always start with a confidential chat about your health. Taylor conducts a thorough assessment, which includes going over your health history, listening to you describe your symptoms, and getting a clear idea of what you’re hoping to achieve with massage therapy.

This conversation is incredibly important. It gives him the information he needs to create a treatment plan that’s not only effective but also completely safe for you. It also provides the detailed notes that insurance companies look for to approve services like deep tissue massage, myofascial release, or rehabilitation massage.

Your comfort and safety are always the top priorities. We maintain a professional, therapeutic environment at all times. This includes using proper draping techniques, where only the area being treated is uncovered, to ensure your privacy and comfort are respected throughout the entire session.

This first meeting really sets the tone for a great therapeutic relationship. The more open you are about your goals, the better Taylor can tailor the treatment to your needs. For a few more pointers, take a look at our article on 5 tips to get the best out of your massage. With a little preparation, you’re all set to start feeling better.

Figuring out the ins and outs of an insurance covered massage can feel a bit confusing at first. Let's walk through some of the most common questions we get from clients across Brampton, Orangeville, and the rest of the GTA.

Is Every Type of Massage Covered By My Insurance?

Generally, yes—if it's a therapeutic treatment from a Registered Massage Therapist (RMT) like Taylor. Standard techniques like Swedish and deep tissue massage are almost always eligible for coverage.

Where it can get tricky is with more specialized modalities. For instance, cupping therapy is often covered, but only when it’s an integrated part of your RMT's official treatment plan. On the other hand, services like Energy Healing typically aren't covered at all. The best approach is always to give your provider a quick call to confirm which specific treatments are included in your benefits package before booking.

What Should I Do If My Insurance Claim Is Denied?

Don't panic! A denied claim is frustrating, but it's usually something we can sort out. Most of the time, it comes down to a simple, fixable issue.

We often see claims denied for a few common reasons:

A required doctor's note was missing.

There was a small error in the submission, like a typo in a policy number.

You've already hit your annual maximum for massage therapy benefits.

Your first move should be to call your insurance company and ask for the specific reason for the denial. From there, let us know what you need. We can provide any necessary paperwork on our end, like detailed treatment notes or an updated receipt, to help you with your appeal. We're here to back you up.

Can I Use My Benefits for a Friend or Family Member?

This one is a hard no. Your insurance benefits are tied directly to you and any dependents listed on your policy, like a spouse or children. They can't be transferred or used for anyone else, no matter how much you'd like to treat them.

The College of Massage Therapists of Ontario (CMTO) has strict ethical guidelines on this. Official RMT receipts must be issued in the name of the individual who actually received the treatment. This maintains professional integrity and keeps everything above board with insurance rules.

How Do I Know If I Need a Doctor's Note?

This is probably the single most important question to ask your insurance provider, as the answer can be completely different from one plan to the next. Many insurers require a physician's referral for massage therapy, and often, that note has to be renewed each year.

When you call them, ask plainly: "Do I need a doctor's referral for Registered Massage Therapy?" If the answer is yes, make sure you have it in hand before your first appointment. Taking this one small step upfront can save you a huge headache and ensure your claims sail through without a hitch.

Ready to put those benefits to good use? Stillwaters Healing & Massage brings professional, therapeutic massage right to your doorstep in Brampton, Toronto, Etobicoke, Oakville, Caledon, Orangeville, Mississauga, Milton, Halton, and Guelph. Book an insurance-covered session with our male RMT, Taylor, and feel the difference.